Stocks have been quite volatile recently, seesawing all over the place but mostly trending downwards for 2022. The S&P 500 has lost about 6% in Jan 2022, the tech-stock-heavy Nasdaq 100 has lost more than 10%. The FTSE 250 is down around 8% for Jan. February also showed negative general performance, the Dow Jones down 4.9%, Hang Seng down 4.6% and as I write Brent Crude Oil price is up 56% since the start of the year.

You don’t have to be an investment legend to know that it’s rarely wise to be a seller in such environments if you can avoid it. Selling into a downturn violates one of the key tenets of successful investing: selling high.

And DIY investors who panic-sell are prone to make emotional decisions that undermine the success of their plans. Even the emotional relief that selling might bring is fleeting, as it’s so often quickly replaced by another nagging worry: Is it time to get back in?

Currently the largest recent event is that over the Russia war with Ukraine. There are also other market headwinds; the Omicron variant of Covid-19 has had a market effect for a few months. The world has logistics and supply chain issues following 2 years of lockdowns. The rising cost of inflation is having a large impact on household bills and budgets.

For some the recent -20% (or more) fall in value since the start of the year in some individual stocks and funds will have caused emotional worry and upset. If this is you then perhaps now is good time to have a re-think?

Is your financial plan and risk strategy correct for you, bearing in mind that these short term falls (traditionally speaking) can be higher still. I’m not trying to cause worry, just historical fact.

If these recent falls have made you overly anxious and perhaps you feel different to that which you would have expected, then it maybe a good time to reassess? Even more so if your personal or financial circumstances have changed in that time period. Perhaps your family lifestyle and goals have changed. Sometimes it is just about having reassurance that what you are doing is valid, confirmation is needed to stay on course.

When markets are choppy, many people get twitchy. They start thinking that it’s better to be safe, to move to cash, that they can avoid potential pain. But those instincts are wrong! Staying invested is the sensible move.

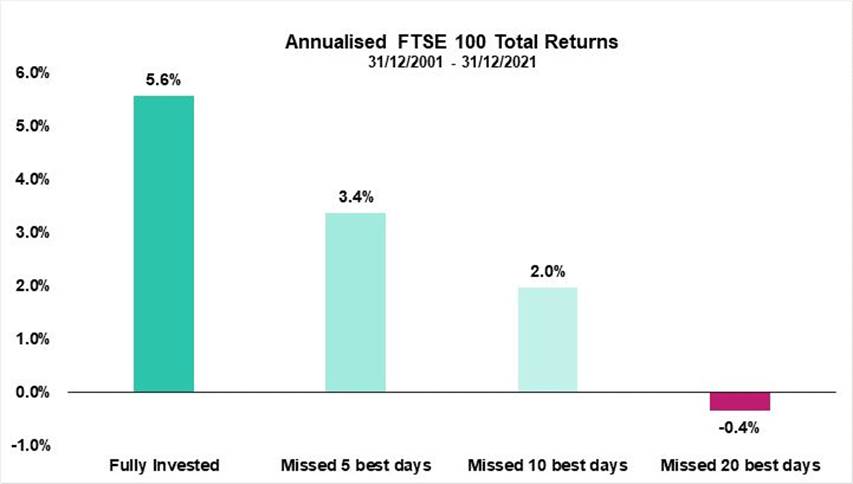

In the last twenty years, if you’d have invested in the FTSE 100, and missed the 20 best days, you’d have lost money (purple bar on the chart).

Further analysis shows that 14 of those 20 best days were within two weeks of one of the 20 worst days. Just when you’re feeling most nervous, is when a big bounce is most likely.

Of course there are sectors that may remain low for some considerable time and some that will recover quicker and It is the job of your qualified investment advisor to discuss these aspects with you. If you have concerns we are always there to have a chat and discuss your worries.

But overall, If one still has a decent investment time horizon, tolerance to risk and capacity for loss, and as long as you feel confident in your investment decisions (backed up by a robust personal financial plan!) then stay the course.

Lee Hinton is an Associate Member of the Chartered Institute of Securities and Investments, holds the Cyprus Ministry of Finance Advanced Examination certificate and holds the UK Diploma in Financial Planning. Contact us on (+357) 26 951 600.