Many UK expats and pensioners may have heard a lot of discussion recently about UK Gilts and the effects that they have on investment funds and may have on future pensions. In very simple terms UK Gilts are “loans” to the UK government. Most investors will hold these in their investment portfolios, both inside and outside of a pension. Those who have wanted to take a “low risk” approach could have quite a bit of exposure to this area as historically they are less volatile than individual company stocks (say Lloyds Bank, BT etc) or most commodities (eg Oil).

Due to the recent “mini-budget” by Kwasi Kwarteng (yep – remember him!) and increasing interest rates investors are seeing unprecedented falls in this asset class.

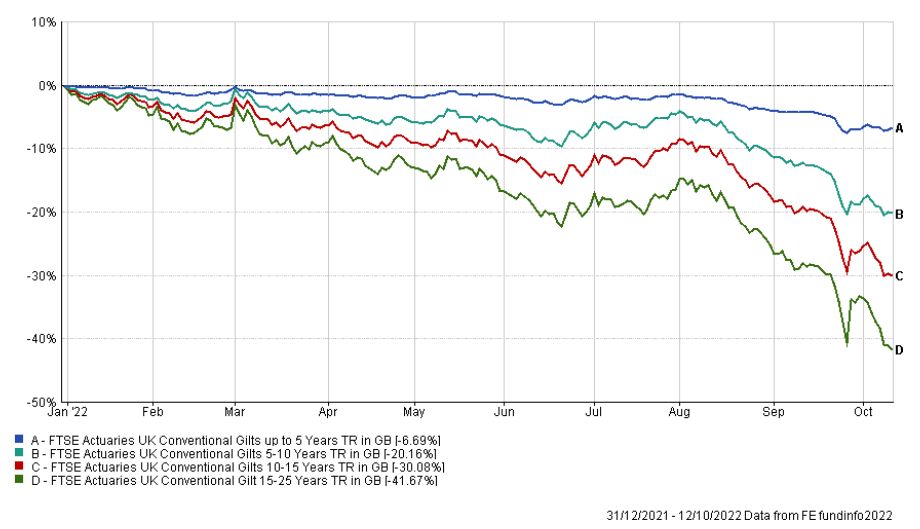

I wish to highlight here that not all Gilts are created equally, in the same way that some banks or retailers are stronger than others, as the below graph shows. Since the start of the year Gilts with a duration of less than 5 years are down -6.69% whilst those with a duration between 15 and 25 years are down -41.87%! A huge difference.

The duration is the time until the “loans” will be repaid. This has a significant impact on volatility levels, this has always been the case but is now magnified in the current environment.

This highlights that “low risk” is not always “low risk”. Of course, all of you that were living in Cyprus in 2013 saw this with the banking ‘haircut’ and the closing of Laiki bank.

The latest Crypto bug is far more exciting than researching UK Gilts and US treasury returns and this can mean that defensive parts of some portfolios can tend to get overlooked (and under-researched), as many inexperienced investors tend to focus mostly on the growth side of their portfolios i.e. stocks and shares.

So, if you are a DIY investor when building the protective element of a portfolio, or if you have one already, perhaps now is the time to double check a few of the following….

– What is the average duration of the underlying bonds?

– What is the geographical spread?

– Are they conventional bonds or index-linked?

– What is the credit quality of the institutions issuing the bonds?

– Is the investment fund currency hedged, if it owns international bonds? (there is no point having a low risk fund that’s subject to massive currency movements!)

These are the kinds of questions built into the Aisa Investment Team’s Governance document.

All of this, and more, should give you a better idea of how the defensive side of your portfolio will react in these testing times and in the future.

A relatively new client called last week and was clearly concerned about the state of the stock market.

“Are my accounts going to go to zero?” – I gave the answer a simple answer of No.

But investors need to appreciate that accounts can go to zero. It’s possible depending on what you invest in.

Ask yourself the following questions.

- Are you investing in a single company? Then Yes, it can happen that your investment reduces to nil.

- Are you investing in a high risk sector such as crypto currency? Then Yes, it can happen in this case too.

- Are you investing in a new tourist restaurant business that you’ve been told about by your mate down the pub? Definitely yes, losing your money is a good probability.

- Are you investing in a variety of good quality companies across a variety of industries and countries? Then it is extremely unlikely your account would fall below your own accepted levels for your risk tolerance and volatility.

Whilst an investor should be reviewing overall asset allocation with the potential to ‘tweak’ here and there, it is unlikely that whole portfolio sales and moving to bank cash will create longer term client investment growth.

With stocks, an investor must take the downside to get the upside. We are in a general downside period right now, and it doesn’t feel good, but stay with it because good companies will pay you back for staying with them.

If you are not sure if DIY investing is for you. Or you wish to have a factual review of your existing portfolios then please to get in touch for a friendly and reassuring chat with qualified and licenced staff.

Lee Hinton is an Associate Member of the Chartered Institute of Securities and Investments, holds the Cyprus Ministry of Finance Advanced Examination certificate and holds the UK Diploma in Financial Planning.